All Categories

Featured

Table of Contents

- – Is there a budget-friendly Indexed Universal L...

- – Is Indexed Universal Life Financial Security w...

- – Who provides the best Indexed Universal Life?

- – How do I cancel Iul Vs Whole Life?

- – What are the benefits of Iul Tax Benefits?

- – Who are the cheapest High Cash Value Indexed...

- – How do I get Iul For Retirement Income?

In case of a lapse, outstanding plan fundings over of unrecovered expense basis will certainly undergo ordinary earnings tax. If a plan is a customized endowment agreement (MEC), plan fundings and withdrawals will be taxed as normal earnings to the extent there are profits in the policy.

It's crucial to keep in mind that with an exterior index, your plan does not straight take part in any kind of equity or fixed income investments you are not buying shares in an index. The indexes readily available within the plan are built to keep track of varied sections of the United state

Is there a budget-friendly Indexed Universal Life Cash Value option?

An index might impact your rate of interest credited, you can not acquire, straight get involved in or obtain returns repayments from any of them with the plan Although an outside market index may influence your rate of interest attributed, your plan does not directly take part in any stock or equity or bond financial investments. Indexed Universal Life for retirement income.

This material does not use in the state of New York. Guarantees are backed by the financial toughness and claims-paying capacity of Allianz Life Insurance Policy Company of North America. Products are released by Allianz Life insurance policy Firm of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. .

Secure your loved ones and save for retired life at the same time with Indexed Universal Life Insurance Policy. (IUL vs whole life)

Is Indexed Universal Life Financial Security worth it?

HNW index global life insurance policy can assist gather cash value on a tax-deferred basis, which can be accessed throughout retired life to supplement revenue. (17%): Policyholders can usually obtain versus the cash money value of their policy. This can be a resource of funds for numerous demands, such as purchasing a service or covering unforeseen costs.

(12%): In some cases, the cash worth and death advantage of these policies may be protected from creditors. Life insurance can also aid decrease the threat of a financial investment profile.

Who provides the best Indexed Universal Life?

(11%): These policies provide the possible to gain rate of interest linked to the efficiency of a supply market index, while also giving an ensured minimum return (IUL for wealth building). This can be an attractive alternative for those looking for development capacity with disadvantage protection. Resources for Life Research Study 30th September 2024 IUL Survey 271 respondents over thirty days Indexed Universal Life Insurance Coverage (IUL) may seem complex initially, yet recognizing its technicians is crucial to recognizing its complete possibility for your financial preparation

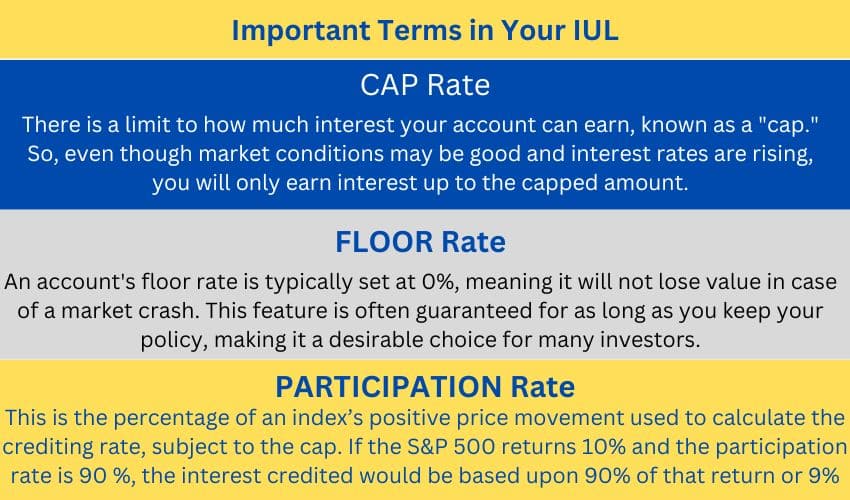

As an example, if the index gains 11% and your engagement rate is 100%, your money worth would certainly be credited with 11% rate of interest. It's important to keep in mind that the optimum interest attributed in a given year is topped. Let's state your picked index for your IUL policy obtained 6% from the start of June to the end of June.

The resulting passion is contributed to the cash money value. Some policies compute the index gains as the amount of the changes through, while various other plans take a standard of the day-to-day gains for a month. No rate of interest is attributed to the cash account if the index decreases rather of up.

How do I cancel Iul Vs Whole Life?

The rate is established by the insurance policy business and can be anywhere from 25% to even more than 100%. IUL policies usually have a floor, frequently established at 0%, which protects your cash value from losses if the market index does adversely.

This offers a level of safety and security and comfort for insurance holders. The passion credited to your money worth is based upon the efficiency of the selected market index. A cap (e.g., 10-12%) is commonly on the optimum interest you can earn in a provided year. The portion of the index's return credited to your cash worth is established by the engagement rate, which can differ and be adjusted by the insurer.

Shop around and compare quotes from different insurance coverage business to find the finest policy for your demands. Prior to choosing this kind of plan, ensure you're comfortable with the prospective variations in your cash value.

What are the benefits of Iul Tax Benefits?

Comparative, IUL's market-linked money value development offers the possibility for higher returns, specifically in good market problems. This capacity comes with the threat that the stock market performance may not provide regularly steady returns. IUL's flexible costs settlements and flexible survivor benefit offer adaptability, attracting those looking for a plan that can develop with their altering economic conditions.

Indexed Universal Life Insurance (IUL) and Term Life Insurance coverage are various life plans. Term Life Insurance policy covers a particular duration, commonly between 5 and 50 years.

It appropriates for those looking for temporary protection to cover particular monetary obligations like a home car loan or kids's education and learning costs or for business cover like investor security. Indexed Universal Life (IUL), on the various other hand, is an irreversible life insurance coverage policy that supplies protection for your whole life. It is a lot more pricey than a Term Life plan due to the fact that it is made to last all your life and offer an ensured cash payment on death.

Who are the cheapest High Cash Value Indexed Universal Life providers?

Selecting the ideal Indexed Universal Life (IUL) plan has to do with finding one that aligns with your financial objectives and risk tolerance. An experienced financial consultant can be vital in this process, leading you through the intricacies and guaranteeing your picked plan is the ideal suitable for you. As you research buying an IUL policy, keep these essential factors to consider in mind: Recognize just how credited rate of interest prices are linked to market index efficiency.

As detailed earlier, IUL policies have different charges. Understand these expenses. This establishes just how much of the index's gains add to your cash money value development. A higher price can boost possible, yet when contrasting plans, evaluate the cash worth column, which will aid you see whether a greater cap rate is better.

How do I get Iul For Retirement Income?

Research study the insurance firm's monetary rankings from companies like A.M. Best, Moody's, and Criterion & Poor's. Different insurance firms use variants of IUL. Work with your consultant to comprehend and locate the ideal fit. The indices tied to your plan will straight influence its efficiency. Does the insurance firm provide a variety of indices that you wish to straighten with your financial investment and risk account? Adaptability is necessary, and your policy ought to adapt.

Table of Contents

- – Is there a budget-friendly Indexed Universal L...

- – Is Indexed Universal Life Financial Security w...

- – Who provides the best Indexed Universal Life?

- – How do I cancel Iul Vs Whole Life?

- – What are the benefits of Iul Tax Benefits?

- – Who are the cheapest High Cash Value Indexed...

- – How do I get Iul For Retirement Income?

Latest Posts

Iul Insurance For Retirement

Iul Master

North American Universal Life Insurance

More

Latest Posts

Iul Insurance For Retirement

Iul Master

North American Universal Life Insurance